Temporal Discounting

- Anthroposphere

- May 31, 2019

- 8 min read

By Luke Hatton

If you were offered £100 today or £110 in three months’ time, what would you do? Chances are, your first impulse would be to opt for the immediate reward, despite knowing that you would walk away with a bigger payoff if you waited. This scenario is examined in the famous Stanford Marshmallow Experiment by Professor Walter Mischel, where children were placed in a room with a marshmallow and told that after a short waiting period, they would be given another – provided they had not eaten the original. Here, an intertemporal decision needs to be made, where the immediate choice affects the availability of a future choice. The immediate reward is smaller than the delayed reward, but many of the children gave into temptation. Children find it difficult to delay gratification, so it is no surprise that many of them went for the immediate reward.

Making an intertemporal decision requires a method of estimating the cost of the waiting period, to compare the value of the rewards and come to a decision. The value of the £110 is seen as lower than £100, due to the cost incurred from waiting, a process called temporal discounting. This process can be explained by construal level theory’, which proposes that the larger the ‘psychological distance’ between a person and event, the more abstract the event seems. This distance can take many forms, including temporal distance. The closer a reward is in time, the more concrete it seems and so the less we discount it, with immediate rewards seeing no discount penalty. We all know the ease at which we can put aside boring tasks for the future rather than doing them now, such as avoiding chores and procrastinating work. This can be explained by temporal discounting.

Climate change, broken down into individual contributory actions towards carbon emissions, is inherently caused by this psychological distance between rewards and costs. Activities which contribute to climate change provide an immediate, tangible benefit. For example, burning fossil fuels provides an output of energy which can be used for heating our homes, running our computers, and fuelling our cars. This is another example of an intertemporal decision, where opting for the immediate benefit will incur a future cost - the ecological and economic damage because of climate change. These costs are significantly delayed, and with such a temporal distance between the benefit and the future cost the cost is discounted heavily. It is difficult to consider the costs due to this weak link.

Difficulty in mitigation is further complicated by the varying levels of wealth between nations and individuals. Imagine that we have two people; Donald and Abdul. Donald is an American millionaire, whereas Abdul lives in poverty on the streets of Dhaka. Returning to the £100 vs £110 scenario, the immediate reward of £100 will be worth far more to Abdul, because of his financial situation. If opting for the £100 immediately comes with a cost in a few decades time, Abdul will still be inclined to opt for this, as he cannot afford not to. Donald, on the other hand, can. In this example, Donald and Abdul’s discounting rates differ because of how much the reward means to each of them: Abdul’s discount rate is higher than Donald’s, meaning that he has a lower present value of future cash flows.

This imagined scenario indicates why less developed countries have a smaller capacity to reduce emissions, because the immediate reward from emissions is needed much more for their economic development. Developed countries also produce a larger proportion of global emissions, so even if developing countries cut their emissions sharply, it would only make a small difference. This can explain some of the reluctance by developing countries to cut down on emissions – with the added resentment that developed countries, who have gone through their industrial development and benefited financially from past emissions, are telling them to constrain their growth to prevent climate change.

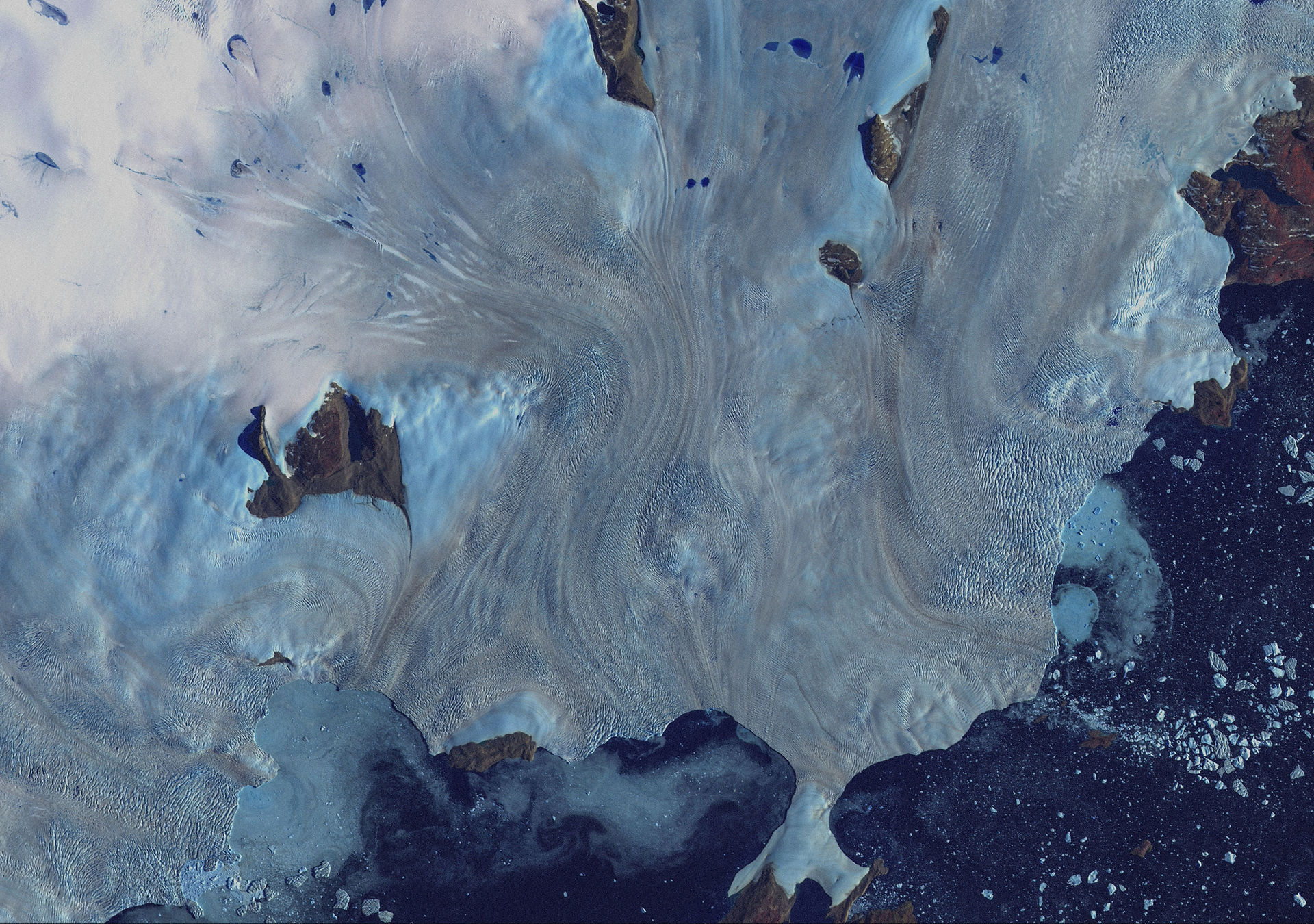

In climate change, another type of psychological distance is introduced - the distance between the self and others - due to the uneven distribution of impacts. Many countries that will be most severely affected by climate change in fact contribute the least to global emissions. Prime examples are small island nations such as the Maldives, the Marshall Islands and Tuvalu, which are low-lying nations at high risk from global sea level rise. Meanwhile, studies show that some developed countries such as the UK, which have contributed significantly to global emissions, may even benefit from mild climate change. Costs incurred to others are more abstract and so are discounted more heavily due to this distance.

*

Following construal level theory, the best way to address discounting is to reduce the distance. The most viable method for this is a carbon tax, which internalises the future cost of emissions – in effect making the temporal distance zero. If you must pay today, you will start thinking for tomorrow. This works through our current market system and would incentivise our largest emitters to cut down on their emissions, balancing the costs incurred through emissions reduction (for instance, higher capital expenditure on energy efficient machinery) against the cost placed on emissions.

Apart from a carbon tax, alternate methods of internalising the future cost do exist. Its main rivals are emissions trading schemes, where emitters are given ‘credits’ which allow them to emit a set amount. As a result, a market for carbon credits is created, where under-emitters can sell surplus carbon credits to over-emitters on the market – putting a price on exceeding the limit and incentivising spending on reducing emissions. However, since regulators have imperfect information, there is no way of knowing the right amount of carbon credits to allocate. This has led to problems in existing schemes such as the EU’s Emission Trading Scheme, whose credit price plummeted to €4 in 2013 due to regulatory oversupply. Furthermore, emissions up to a certain level are still permitted, and so the psychological distances associated with these are not being reduced.

While a carbon tax avoids this problem by setting a standard cost on carbon, there still exist difficulties, mainly with determining the ‘right’ price. The difficulty lies in quantifying the cost of climate change, a tall task even if we knew the precise metrics of temperature rise. This lack of perfect information, combined with the difficulty in valuing natural systems such as the nutrient cycle and atmospheric regulation, means that there is significant uncertainty in determining the right cost of a carbon tax.

Even experts lack consensus over the ‘correct’ price for carbon. Sir Nicholas Stern, chair of the Grantham Research Institute on Climate Change and the Environment at the London School of Economics, estimated in the Stern Review of 2007 that the future cost per tonne of carbon emitted would be $85. This was derived from a set of calculations based on future climatic impacts, and involved the use of discount rates, which reduce the value of future benefits and costs relative to the present time. Discount rates comprise of two sub-rates – the falling relative price of goods due to technological change and economic growth, and a temporal discounting rate, also called the time preference. Stern used an average discount rate of 1.4% per year, meaning that a cost or benefit incurred in 50 years will be worth half of the same benefit today. However, his discount rate comprised of an ignorable rate of time preference, as Stern argued that using any rate above zero to advise policy decisions would be ethically inappropriate – prioritising the current generation over future generations is not justifiable. This meant that his calculations were based entirely on the falling value of money, sidestepping the problem of temporal discounting.

Stern’s report concluded that emissions could be cut by spending an estimated $25 per tonne of carbon, for example via investment in renewables, efficiency measures or a carbon tax. With a current spend of $25 per tonne now, a loss of $85 per tonne in the future incurred by the impacts of climate change (such as heavier flooding, drought and sea level rises) could be averted. Yet this figure was criticized by Professor Nordhaus, Sterling Professor of Economics at Yale University and 2018 Nobel Prize winner in Economics. He criticised Stern’s low discount rate as inconsistent with market interest and saving rates, and so not accurately accounting for the future change in the value of money.

Within his own research, Nordhaus used a discount rate which included a time preference rate of up to 3%. This rate means that a cost or benefit occurring 25 years in the future is worth about half of the same benefit today, all other things (such as the value of money) being equal. This reflects the view of many economists, who see a time preference as justified due to our psychological present bias, despite the ethical difficulty in including this in impact assessments. Professor Nordhaus thus estimated the real future cost of emissions at $30 a tonne. The difference between their estimates of the cost of emissions can largely be explained by the difference in their time preference rates.Both Nordhaus and Stern’s calculations conclude that there would be a net value in spending on mitigation, as the costs of climate change outweigh the costs of mitigation. However, without a global carbon tax, overcoming the psychological ‘present bias’ that exists because of temporal discounting will be incredibly difficult. This reflects a growing consensus, explored by Professor Richard Thaler, 2017 Nobel Prize winner in Economics, that policy decisions need to create a ‘choice architecture’ which works with our psychological tendencies and biases to ‘nudge’ us towards the right choice, so that we can address national and global issues.

In the context of climate change, it seems that our society is still in the childlike phase of prioritising the immediate reward over the larger, delayed reward. As a result, we need a way to overcome our psychological tendency towards short-termism if we are to work towards mitigating climate change. The most viable method of doing this is a carbon tax. In the context of the Marshmallow Experiment, introducing a carbon tax is akin to removing part of the first marshmallow, making the immediate reward significantly smaller in relation to the future reward. The question for policy makers and experts alike remains of just how much we need to remove, for us as a society to fully resist temptation and wait for the second marshmallow.

Luke Hatton is a first-year student at New College reading MEng in Engineering Science. He grew up in Bristol, one of the greenest cities in the UK, and so has always been exposed to concepts of sustainability. He is building on this by participating in the Oxford School of Climate Change, run by the Oxford Climate Society. He is interested in how technology and society interact, a topic which he explored in a research project with the Schumacher Institute, a Bristol-based think tank. Because technology is often both the solution and cause of the problems humans face - especially with climate change - he believes in the importance of engaging both science and humanities perspectives on the subject. This is why, even as an engineer, he has written an article about the economics and psychology of climate change!

Art by Abigail Hodges

This article first appeared in the print edition of Anthroposphere Issue III. If you like what you've just read, please support Anthroposphere by buying one of our beautifully designed physical copies here. All proceeds go towards printing, designing and maintaining our publication, and your contributions will help keep our climate journalism interdisciplinary and accessible for all.

Comments