Blockchain against Climate Change

- Will Taylor

- Apr 12, 2021

- 8 min read

Updated: Sep 14, 2021

A new technology for environmental protection?

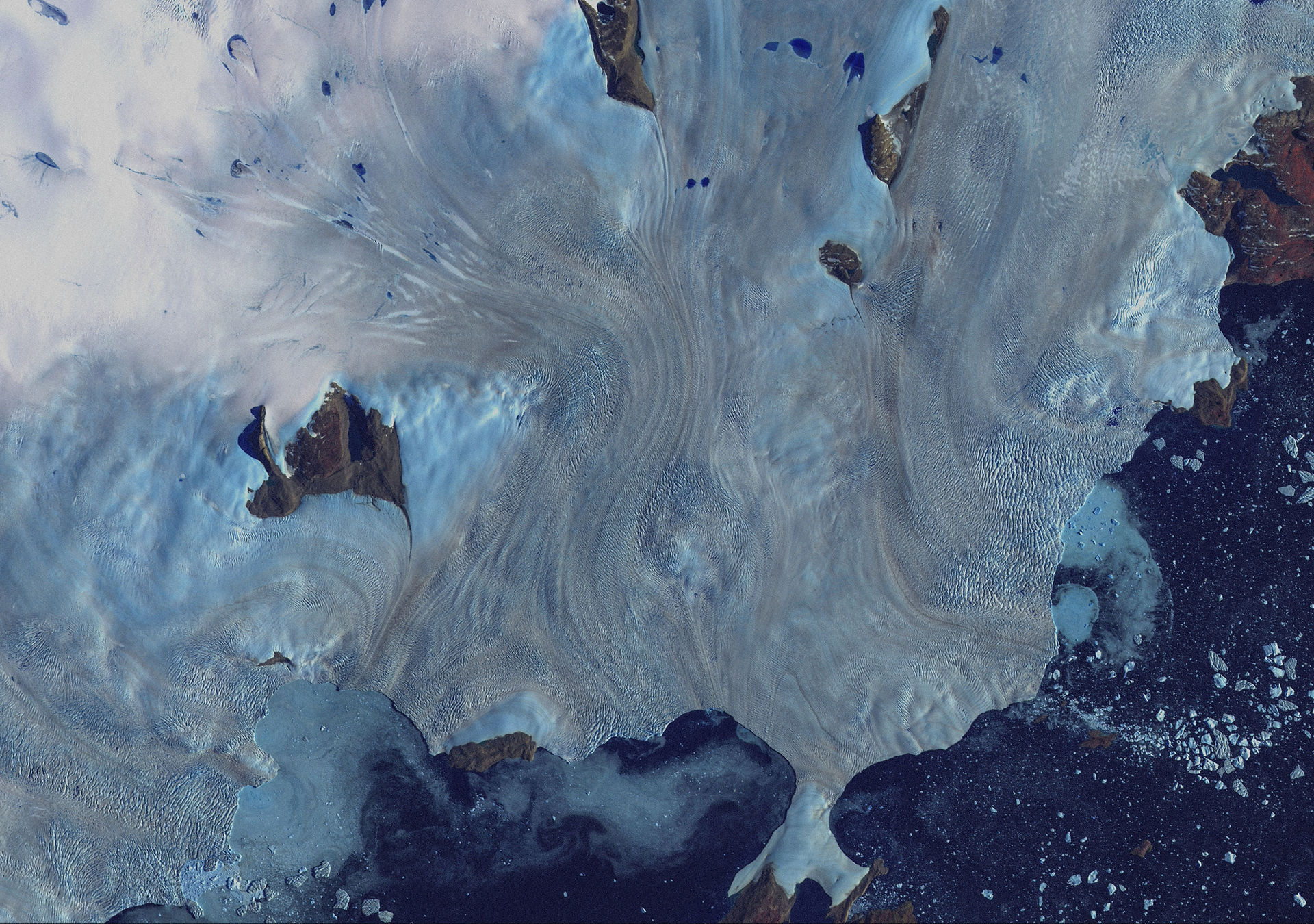

The end of 2017 brought to a close a year pockmarked by extreme weather events and bad news for the world’s climate. The third hottest year since records began and the warmest non-El-Niño event, last year saw further swathes of the Great Barrier Reef bleached, sea ice extent contract to record lows at both poles and enough deforestation to cover an area the size of Spain. The uneasy warnings that the Paris Agreement’s commitment to limit total world temperature rise to 2°C seemed increasingly optimistic (if not downright implausible) and were strengthened by the Trump administration’s public withdrawal from the accord and the revelation that after the plateau of the last three years, global CO2 emissions were predicted to rise by a further two percent.

If 2017 was disquieting for climate scientists, it was also disturbing for financiers. Despite UBS’ chief economist comparing Bitcoin’s rise in prices to the 1637 tulip bubble and the hyperinflation of the Weimar Republic, JP Morgan’s CEO Jamie Dimon labelling it a “fraud” and numerous central banks threatening crackdowns, the cryptocurrency rose from a price for one Bitcoin just shy of one thousand dollars to a peak near 18,000. Other cryptocurrencies recorded similarly astronomic appreciations in value as new investors piled in. The 18-fold increase in value also prompted Bitcoin miners to redouble their efforts: the energy consumption of the network now stands at an estimated 36 terawatts a year, roughly equivalent to that of Bulgaria (a country of some seven million people).

Despite the inability of governments in both cases to take concerted action on an exponentially growing global phenomenon and Bitcoin’s growing carbon footprint, the rise of cryptocurrencies and climate change are connected by more than bad news. The challenge to preserve the planet’s resources, mitigate the effects of climate change for the world’s poor and leave the Earth habitable for generations to come demands cooperation between multiple stakeholders, transparency and a deep commitment to change behaviours across all levels of society. Blockchain, the technology on which Bitcoin and other cryptocurrencies are built, holds promise for confronting these challenges.

Blockchain technology combines three features to make this happen. A blockchain is a decentralised network. Unlike a website such as Wikipedia, where members of the community send in edits to a central database, each member has their own copy of a record which lists the transactions made between members on the network. Each member also has a unique digital identity; when they want to make an exchange of value on the network, the rest of the community checks that it’s not fraudulent. So that members don’t dilute the value of tokens on the network by sending the same token multiple times, transactions are added to a bundle of exchanges and approved once a majority of members has voted that they’re legitimate. Once approved, the bundle of transactions (a ‘block’) is added to the record of all the previous blocks held by every member (this chain of blocks is where the name derives). Because everyone on the network has their own record of every transaction, it’s easy to track how the tokens move through the network between unique members and it’s hard to change the record – you would have to persuade a majority of the individuals in the community to make alterations.

There are three important takeaways from this. The first is that digital tokens can be transacted and preserve their value. Because you can infer from the network the location of every token, you can stop its members from copying and pasting the tokens into hyperinflation. The second is that the record of transactions is immutable. Each member has its own copy of the ledger so it is highly difficult to alter it retroactively. The third is that all these members have their own identity attached to the transactions they make and the tokens they hold. These features can help fight climate change in a number of ways.

Climate finance

Fighting climate change is a global issue. It’s high on the United Nations’ agenda and countries have made international agreements to fight climate change’s effects. In 2005 the international community ratified the Kyoto Protocol, which placed legally binding emissions limits on countries. However, opinion in the international community has shifted. The Paris Agreement, entered into force November 2016, relies upon unified political will in the face of a shared danger instead of limits set from the top down: individual states make their own Nationally Determined Contributions (NDCs). Though taking different forms, NDCs work towards climate change mitigation and holding temperature rises under two degrees Celsius.

The Paris Agreement also recognises the importance of other stakeholders – commitments to finance climate change mitigation are made by both public and private institutions. The challenge is an urgent one: the longer emissions are allowed to rise, the steeper the future reductions which must be made to stay within the agreed goals. However, the actors responding to the challenge are siloed across different organisations with different goals and different plans of action.

The global effort to combat climate change is expensive. Immediate commitments from developed nations to aid developing countries in their mitigation efforts total some 100 billion dollars. New Climate Economy estimates some 93 trillion dollars of investment across the world economy will be necessary to avoid dangerous rises in global temperature. However, while it is easy to make pledges and simple to throw money at the problem, ensuring that the money is well spent is another matter.

Only ten percent of the Chinese green bonds are independently verified as environmentally friendly.

Corruption and a lack of transparency has hindered efforts and harmed local communities. Between 2000 and 2010, 500 million acres of land in Latin America, Africa, Asia and the Caribbean were acquired for biofuel cultivation in deals negotiated by transnational corporations and foreign governments, concentrating land ownership in the hands of a wealthy elite. The EU’s carbon credit trading scheme was the victim of both private and public sector fraud, costing millions.

Similar problems afflict the green bond market – investors want to lend money to projects which will help the environment but find it hard to make sure they deliver their promises. Demand for environmentally friendly debt has climbed steadily over the last five years but problems remain. Despite Poland’s obstruction of EU debate on climate change measures and deforestation, their sovereign green bond was oversubscribed. Only ten percent of the Chinese green bonds which make up a fifth of the market are independently verified as up to scratch.

Blockchain offers a solution to the problems of paying for our future. Every member of a blockchain network has a copy of the decentralised ledger which makes hiding corrupt transactions much harder. One of the problems with the current system is its opacity; people with money in investment funds can’t see who the funds are investing in very easily and even when they can the money is often transferred between several third parties before reaching its source. If normal people could see how the money flows and where it ends up, corrupt uses of climate funds could be held to account.

Streamlining aid

Perhaps more revolutionary is the way blockchain could change climate change mitigation for some of the world’s most vulnerable. The World Bank has estimated that around 2 billion people lack access to financial institutions. Lacking formal systems of credit means a huge loss in productivity – investments which could help a farmer in Uganda increase the yield of their farm are left to lie fallow.

In part, this is caused by a lack of formal documents. Though the farmer may work fields they have occupied their whole life, without a registered land title, a bank has no collateral against which they can lend. Companies in Ghana and Georgia as well as the Swedish government are putting land title on blockchains, creating immutable records of who owns tokenised parcels of land. As well as allowing access to formal systems of credit, the process stops corrupt land theft. More generally, blockchain can make local trust visible outside the community. For those whose standing in their community is good but who are unknown and lack formal documentation, blockchain can replicate this local trust on a global scale.

By placing local trust on a blockchain, the power of decentralised networks can be leveraged to provide fast solutions to urgent climate problems. Instead of relying on aid filtered through NGO and governments — often vulnerable to corruption — blockchain could allow instant peer-to-peer aid or micro-financing for climate change mitigation. Long droughts or extreme floods are afflicting communities now and will only get worse as once-in-a-hundred-year events become the new normal. To ensure large swathes of the planet remain habitable, climate change adaptation must happen fast. However, disbursing money to those most directly in need is difficult. Transferring funds from individual donors through multiple third parties to the intended recipient creates administrative costs and significant frictions.

Decentralised networks could accelerate the process through peer-to-peer aid. If a community wants to build new embankments for a river that is rising higher each year, donors could give money directly. With no middleman, administrative costs would fall and communities would be able to deploy the resources with greater speed.

However, as with many of the possible applications of blockchain, its use here should come with qualifications. Communities still need to have access to technology, putting this solution out of reach of the poorest and most vulnerable. Moreover, the benefits of some central control should not be overlooked. Though friction in transferring money is undesirable, the work done by NGOs is. Blockchain could increase the amount of money donated and the speed with which it reaches its target but it cannot give the expertise necessary to use it well: knowledge transfer still has a role to play.

Protecting habitats

As well as climate change adaptation, blockchain can prevent environmental degradation. A global economy means very complicated, cross-border supply chains. Companies who want to ensure that the raw materials in their products are sourced without environmental damage face significant challenges. Raw materials from hundreds of individual suppliers are shipped via third party logistics providers to processing plants, fashioned into the final product and dispatched to retailers.

Tokenising the raw material on a blockchain allows stricter application of corporate standards: corrupt accounting is made harder by registering transactions between parties on an immutable ledger. Whether avoiding power from dirty, coal fired stations or soy beans from deforested fields, blockchain can help consumers and corporations mitigate their environmental impact.

While blockchain is an exciting technology with the potential for real improvements to existing systems, it is not a substitute for them.

Blockchains can also incentivise behaviours at the other end of the supply chain. Blockchains allow transactions to be made automatically, cutting out the need for a middleman to verify certain criteria of a contract are met. Smart contracts in computer code on a blockchain allow automatic transactions if conditions are met. A collaboration between Carbon Conservation and Smart Contract for Good is currently using these automatic contracts to mitigate deforestation in Indonesia. From a $100,000 fund pledged by corporations sourcing palm oil from the country, communities receive automatic payments if they reduce incidences of forest fire. The speed of the transaction incentivises protection of long term assets like rainforest over the short term windfall from land clearance and the annual release of the money is timed to coincide with fire season. Similar processes could remunerate those whose land or business is damaged by wildlife, like farmers whose crops are damaged by elephant herds, and reward ethical use of resources, such as fishermen staying within quotas.

All these use cases come with a caveat. While blockchain is an exciting technology with the potential for real improvements to existing systems, it is not a substitute for them. A blockchain can only help a company reduce its exposure to palm oil or soy beans harvested from charred fields if it wants to do so in the first place. A blockchain can only streamline climate bond verification if the processes are followed in the first place. A blockchain cannot help the unbanked and unregistered fight climate change if they don’t have access to the requisite technology. Blockchain can help individuals, communities, cities and states cooperate but it can only do so if the will to fight for the future of the planet is shared between them.

Will Taylor read Classics at Oxford. He likes coffee, climate and cryptocurrencies.

This piece originally appeared in Issue I (Spring 2018).

If you like what you've just read, please support Anthroposphere by buying one of our beautifully designed physical copies here. All proceeds go towards printing, designing and maintaining our publication, and your contributions will help keep our climate journalism interdisciplinary and accessible for all.

Comments