China's Renewable Energy Policies

- Anthroposphere

- Mar 24, 2019

- 11 min read

by Yuan Ting Lee

Since the turn of the century, China has boldly put into place policies to incentivise the production of renewable energy and to reduce its dependence on coal. At the moment, China is the world leader in the deployment of renewable power, with more than twice as much installed capacity than any other nation. It is also the largest investor in renewable energy – an astounding 70% more than the second largest investor, the United States. Yet, it is still the world’s largest consumer of coal and burns about half the world’s coal; coal remains a vital resource in the nation, constituting over 60% of the primary energy demand as well as a huge source of economic activity.

As China seeks to increase its investments in renewable energy, it faces the struggle of divorcing energy production from economic advancement, and the difficult transition to renewables. It is no longer enough to simply build additional capacity: as countries like Germany have shown, greenhouse gas emissions have not decreased despite a rapid growth of renewable energy plants in the power sector. This broaches the pressing question: what is the role of renewable energy in China’s current energy outlook, and how will it deal with the problem of coal, which remains a troublesome economic powerhouse?

What is the role of renewable energy in China’s current energy outlook, and how will it deal with the problem of coal?

China’s policy goals typically focus on relative shares of energy in the market. Globally, carbon emissions are modelled by the Kaya identity: a function of income per capita, energy intensity of GDP and carbon intensity of energy. Currently, China targets a reduction in carbon emission intensity by 40-45% and 60-65% by 2020 and 2030 respectively, compared to its 2005 carbon emission levels. This can be achieved by improving fuel efficiency, carbon capture and sequestration, or negative emission technologies. On paper, China has managed to meet its 2020 target early: in 2017 it reduced its carbon intensity level by 46% with respect to the 2005 baseline. This is impressive at first glance. However, it might suggest that targets are not ambitious enough and that there is further room for improvement. Climate Action Tracker also rates China’s current commitments as “highly insufficient”, signalling that China’s current Nationally Determined Contributions (NDCs) and national actions are not yet consistent with limiting warming to below 2 ºC. It also raises the question of whether avoiding setting direct emission reduction targets in the interest of economic growth has a significant impact on its overall emission reductions, lessening the likelihood of meeting the Paris Agreement goals.

Looking back to the start of China’s renewable energy policies, 2005 was the first decisive move towards energy transition with the introduction of the Renewable Energy Law. This law encouraged the development of various types of renewable energy such as wind, solar, and biomass energy in China. It provided the legislative support to renewable energy development in the country by recognising the key role of these energy in sustainable and social development. Additionally, it clarified the responsibilities and duties of governments, private developers and end users in the development process. However, it took until 2009 for the government to amend the Renewable Energy Law to propose specific provisions targeting development of renewable energy, which included the establishment of the Renewable Energy Development Fund and Feed-in Tariffs (FIT). FITs are a scheme under which power grid operators are required to purchase electricity produced from renewable sources at a price determined by the regional public authorities and guaranteed for a specified period of time. This operates as a subsidy allocated to producers of renewable energy, as their costs of production are lowered. Currently, FITs are the main policy tool used by the Chinese government to promote the growth of renewable energy, in particular wind and solar energy, and they have proven to be successful in increasing incentive and boosting development.

2005 was the first decisive move towards energy transition with the introduction of the Renewable Energy Law [...] However, it took until 2009 for the government to amend the Renewable Energy Law to propose specific provisions targeting development of renewable energy.

Another major incentivising factor for the growth of the renewable sector in China was the initial setting of clear and attainable targets. In the most recent Five Year Plan (2016-2020), the Chinese government set out a plan to increase the share of non-fossil fuels in their primary energy demand to around 20% by 2030. This was further substantiated with a goal to attain a 15% share of non-fossil fuels in primary energy consumption by 2020. By 2017 this share, or energy mix, was already at an impressive 13.8%. However, the share of “non-fossil fuels” includes nuclear energy and thus is not truly comprised of totally renewable energy. Recently, the targets China has been setting are much less realistic: the 13th FYP from 2016 stipulates a maximum 58% share of coal in national energy consumption by 2020. According to the World Resources Institute, current calculations indicate that in order to meet the 20% target China would have to deploy an additional 800-1000 GW of low-carbon power generation. To put this into perspective, this is close to the United States’ total current electricity capacity. Given China's current trajectory, it is unlikely that this target will be met.

Current calculations indicate that in order to meet the 20% target China would have to deploy an additional 800-1000 GW of low-carbon power generation [...] Given China's current trajectory, it is unlikely that this target will be met.

Within this plan, specific targets were also set out for wind and solar PV energy: to achieve 210 GW and 110 GW of grid connected power respectively by 2020. Each province was set specific deployment goals, and a goal of 420 TWh for electricity generation for wind power was also fixed. As of 2017, China already had 164 GW and 130 GW installed capacity of wind and solar, once again being ahead of the game in achieving set targets. However, a key difference between the goal and reported data is that grid-connected power is a subset of installed capacity, as power generation plants are only able to supply energy to consumers once it has been connected to the grid. This concept of grid disconnectivity is important for the global climate agenda as installed capacity of renewable energy is not useful unless it is connected to the grid and supplied to consumers: only then can it count as replacing fossil fuels. As such, the achievements made by rapid construction and installation of renewable energy plants do not directly achieve the targets set in terms of supplying the consumer. In fact, compared to the US, where it is projected that renewables will have a 23% and 31% share in the power mix by 2030 and 2050, China is not setting ambitious enough goals if it still aims to become a world leader in climate change action, nor is the data produced as transparent as it ought to be. In August 2015, Premier Li Keqiang said that China would "strive for zero growth in the consumption of coal in key areas of the country", but yet at least 38 GW and 35 GW of new coal power plants were commissioned in 2016 and 2017, signalling a divergence in policy commitments and their actual implementation.

China is not setting ambitious enough goals if it still aims to become a world leader in climate change action, nor is the data produced as transparent as it ought to be.

Despite the huge increase in installed capacities for both wind and solar energy in China, there are some problems that plague the installations, preventing renewables from achieving its full potential in the country: curtailment, lack of grid connection, funding, and dependency upon fossil fuels. Curtailment of power and lack of grid connection are interconnected: curtailment refers to a reduction in the output of a power generator from what it could otherwise produce given available resources (e.g. wind or sunlight), and the lack of grid connection refers to a lack of coordination between the power supplies and grid connectors.

Wind and solar power curtailment occur in China for two principle reasons: first, thermal power plants still have priority over wind and solar plants under electricity dispatch rule. Therefore, when power systems have excess capacity, wind and solar energy is not required, as most of the power generated from fossil fuels is sufficient for meeting demand. Second, wind and solar plants are sometimes built without transmission connections which causes a time lag of several months or even years before deployment. In addition, the current grids in the electricity sector are designed for large scale production suited for supply from fossil fuel plants, and not adapted to a smaller scale which suits the intermittent nature of renewable energy. Curtailment tends to be a bigger problem in regions with more established renewable power plants and the lack of grid connection is more prominent in areas with newer plants.

This relationship is shown in the figure below, where at first glance it appears as if regions with the highest disconnected capacity also have the highest curtailment rates. Yet when this is adjusted for the provinces’ total capacity and electricity generation, it shows that curtailment rates are highest in the Northern provinces, but the rates of disconnected capacity are actually highest in the Central and Southern provinces.

In the early days of China's development of wind power, the initial focus was on the Northern provinces as they are the most abundant in wind resources. While grid connection was at first a problem in those areas, over time, the country made progress connecting the turbines to the grid. Disconnection rates are thus now higher in the Central and Southern regions that have newer wind farms. In 2015 and 2016, curtailment rates for wind and solar power were in the range of 15% – 20% nationally, reaching 40% in some provinces. In 2016, wind curtailment caused economic damage valued at RMB18.7 billion (USD 2.8 billion) to wind power plants. If this curtailed wind electricity were to replace coal-fired power production, 42 million tons of carbon dioxide would be cut out. Whilst curtailment problems also occur in other parts of the world, it is certainly a prominently Chinese problem; the US wind curtailment rate in 2014 was approximately two percent, and the highest ever was 11% in 2009.

Looking at the policy design for development of renewables in China, policies such as feed-in tariffs generally reward the construction of renewable facilities, but only offer weak incentives to consider the characteristics of renewable power (e.g. the intermittency of wind) and grid connection challenges at the construction location. These are therefore major factors which are hindering China’s total transition into renewables, despite its great efforts to implement huge capacity.

Another important factor in all this is the issue of funding. With guaranteed prices as a result of the FIT, solar power manufacturers and other companies started building solar farms as it was profitable to do so. In December 2013, it was revealed that there were 130 GW of “queued” solar projects, which was three times the entire target set out in the 12th Five Year Plan. However, the Renewable Energy Development Fund, from which subsidies are paid, only has one source of income: a renewable energy surcharge on electricity bills. Without a quota to limit the amount of installed capacity in renewables, this would result in constant upward adjustments of the surcharge which will one day be insufficient to fund the projects themselves. Indeed, the surcharge has already been adjusted five times and is now 0.019 RMB/kWh. Renewable subsidies are increasingly becoming a burden and Chinese consumers have borne the brunt; the state-run renewable energy fund currently has a deficit of more than 100 billion RMB.

Moving forward, the promotion and development of renewable energy in China must become decoupled from subsidies for a sustainable growth trajectory. The modification of the existing fixed-price feed-in tariff system to an auction system offers one avenue for a sustainable funding mechanism. In an auction system, authorities set the capacity of energy up for auction, and project developers bid for these lots of energy with proposals on how to realise the energy production and electricity generation. Germany is an example where such renewable energy auctions have been successfully implemented. If designed well, ‘auctions can help to provide real-world prices for renewables, avoid windfall profits and/or underfinanced projects that do not get built’, reports dena, the German Energy Agency.

Yet the juggernaut still remains unmoved: coal. China's dependency on coal as its greatest provider of energy significantly hinders the proliferation of renewable energy. Curtailment of renewable energy actually perpetuates part of the problem of coal dependency in China, as coal power production goes up with increased curtailment. Additionally, the country's power sector still mainly operates through planned allocation of generation, thereby making it difficult to reduce coal consumption since coal power plants are guaranteed access to the power grid. Between 2016 and 2017, the National Energy Administration issued a series of orders to stop or delay the construction of over 150 planned coal plants. In a 2017 speech, Premier Li Keqiang announced the need to “speed up the resolution of problems associated with coal-fired pollution” and implemented a target to stop, delay and close down at least 50 GW of coal-fired power plant projects.

China's dependency on coal as its greatest provider of energy significantly hinders the proliferation of renewable energy.

However, in many cases, it was found that these rules were either ignored entirely, or that construction plans were simply “delayed” until after 2017. According to a report by CoalSwarm, “259 GW of new [coal] capacity is under development in China, comparable to the entire US coal fleet (266 GW).” This not only has massive consequences for China’s carbon emissions and is “wildly out of line” with the Paris Agreement, but also has negative implications for the future of renewable energy in the country: as long as coal plants are given preference in the power grid and not phased out, it will be difficult for renewable energy to capture a market majority. Despite a pledge by Liu Jieyi, China’s Ambassador to the UN, that China’s emissions would peak “by 2030 or even earlier”, recent official data has shown a 3% year-on-year increase in emissions in the first half of 2018. Whilst this rise is not indicative of a trend, it is still significant and cause for concern, given that this increase in emissions was coupled with a 3% increase in coal consumption in the same time period.

Over the past 15 years, it can be seen that China’s efforts towards developing renewable energy in the country have undergone a dramatic transformation which has led to them becoming world leaders. Target-setting for installed capacities as well as the introduction of feed-in tariffs have greatly encouraged the building of wind and solar farms. However, this rapid development has been undercut by high curtailment rates and grid-connection delays, which have resulted in a massive shortfall of the power generation potential of renewables. It is also clear that China will never be able to truly call itself a leader in renewables without a serious and imminent crackdown on coal consumption. If renewable energy (including nuclear) curtailments were effectively mitigated, the coal use for thermal power generation would decrease by about 38 million tons, accounting for 100 million tonnes of CO2 emissions reduction.

Much greater policy effort is required in order to tackle reform in China’s power sector in order to align the national policy with a 1.5 ºC compatible pathway. Considerations about project design, as well as a shift towards market-oriented policies to support the development of renewables, are changes which must be made in order to improve the efficiency and output of renewables in China. While current statistics in the renewable sector show remarkable potential, without guidance and effective management of the growing renewables sector, China will not maximise the full benefits that the burgeoning renewables sector promises.

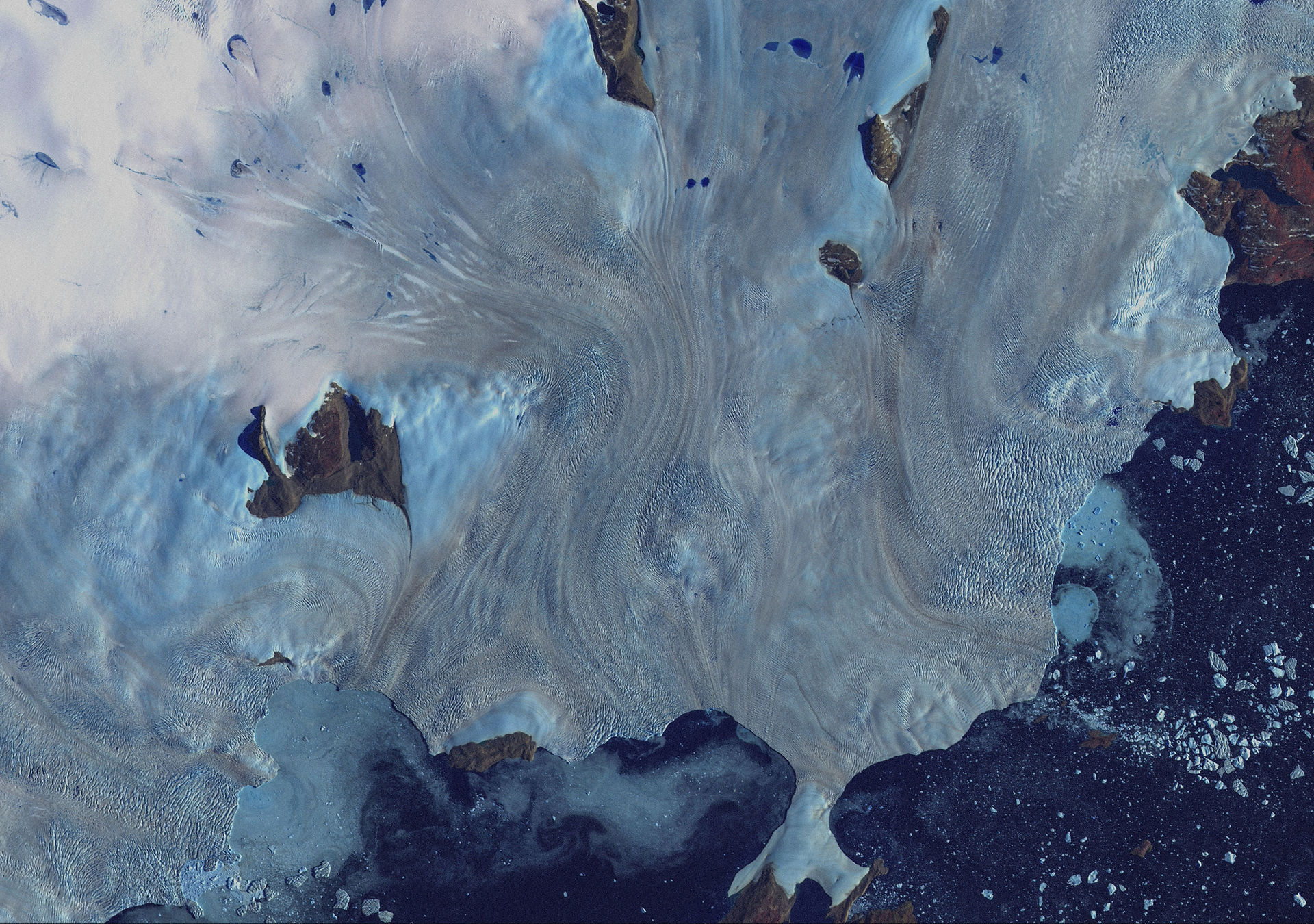

Illustration by Ann-Kathrin Görisch

Yuan Ting Lee is a Master of Public Policy (MPP) student at the Hertie School of Governance and works as a Research Assistant for the Applied Sustainibility Science working group at the Mercator Research Institute on Global Commons and Climate Change (MCC) in Berlin. She also has experience in the public sector, having worked for the Ministry of Foreign Affairs and Ministry of Transport in Singapore. Previously, she graduated from Imperial College London with a BSc in Chemistry. Outside of work, she can often be found roaming the streets of Berlin searching for the best coffee in the city, practicing speaking German, and spending time with her roommates’ three cats.

If you like what you've just read, please support Anthroposphere by buying one of our beautifully designed physical copies here. All proceeds go towards printing, designing and maintaining our publication, and your contributions will help keep our climate journalism interdisciplinary and accessible for all.

Comments